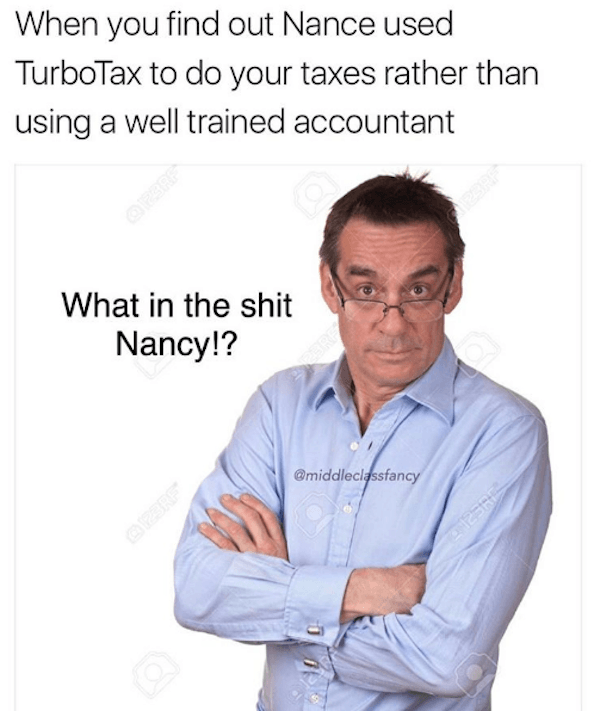

Image credits: middleclassfancy #18 The Clogging Of Your Arteries Is A Sign Of Ketosis credits: adamthealright Image credits: middleclassfancy #17 It’s Fall Y’all By paying yourself first after each paycheck, and making it hurt a little to change your spendy ways, only then will you know whether you are saving enough.” #16 Extra Ketchup Plz Stream The Harper House, Exclusively On #ad Then they wake up 10, 15, 20 years from now and wonder where all their money went. “One of the key mantras I tell my readers is this: If the amount of money you’re saving each month doesn’t hurt, you’re not saving enough! Too many people go through life, paying no attention to their finances. The more people are empowered with financial knowledge, the better financial decisions they can make to ultimately live the lives they desire.” #13 Congrats On The New Ride credits: middleclassfancy #14 Nice SubaruĪccording to financial expert Sam, saving has to ‘hurt,’ otherwise, you’re likely not saving enough. “In another example, if more people knew they could negotiate a severance instead of quit with nothing, more people would have a more comfortable financial runway to take their time and find a new job or start a new business that is truly meaningful to them. Image credits: midclassfancy #12 You Wanna Use Your Sick Days Too You Bag Of S**t? For example, if more people thoroughly understood their mortgage contracts before signing, the housing crisis between 2008– 2010 may not have been as deep,” Sam said that financial education can even help reduce the severity of economic crises if applied properly and on a wider scale. “We learn things like chemistry, geology, and English in high school and college, but there are no mandatory courses on personal finance. Sam Dogen, the founder of the Financial Samurai personal finance website, told Bored Panda during an earlier interview that the biggest barrier for people to become rich is the lack of education. However, what is a problem is the lack of financial education in schools. There’s absolutely nothing wrong with financial stability or providing for your family. At the same time, 22 percent of upper-income Americans were in the same situation. The Center’s survey from April and May 2020 found that 36 percent of lower-income and 28 percent of middle-income adults lost their jobs or had to take a paycut because of the pandemic and lockdowns. Pew Research explains that it’s not just the working class that felt the brunt of the Covid-19 pandemic. In short, it’s implied that the American middle class is shrinking and getting poorer, as the population in the extreme bottom and top of the economic spectrum continues to increase. Image credits: middleclassfancy #5 It’s Quite Simple credits: TheAndrewNadeau #6 The Millennial credits: Joe_WBarnes Meanwhile, in 2014, the share dropped down to just 43 percent.

The share of income it was capturing stood at 60 percent back in 1970. Investopedia notes that the middle class in the US is pulling in far less income than half a century ago. The tagline of MCF is that “LiFe Is GoOd.” A little too good for some middle-class homeowners, judging by the memes the page keeps posting.ĭespite all the humor, there are some serious issues affecting the middle class. A further 122.5k people follow the project’s page on Facebook while Twitter brings in another 16.4k followers.

The ‘Middle Class Fancy’ project has a whopping 2.4 million fans on Instagram.

0 kommentar(er)

0 kommentar(er)